Leading industry voices came together for a roundtable discussion hosted by BE News and sponsored by Yardi to debate the role data and technology could play in helping sustain growth in the retail sector.

INDUSTRY GUESTS:

- Mike Cook, director, UK and Ireland, Yardi

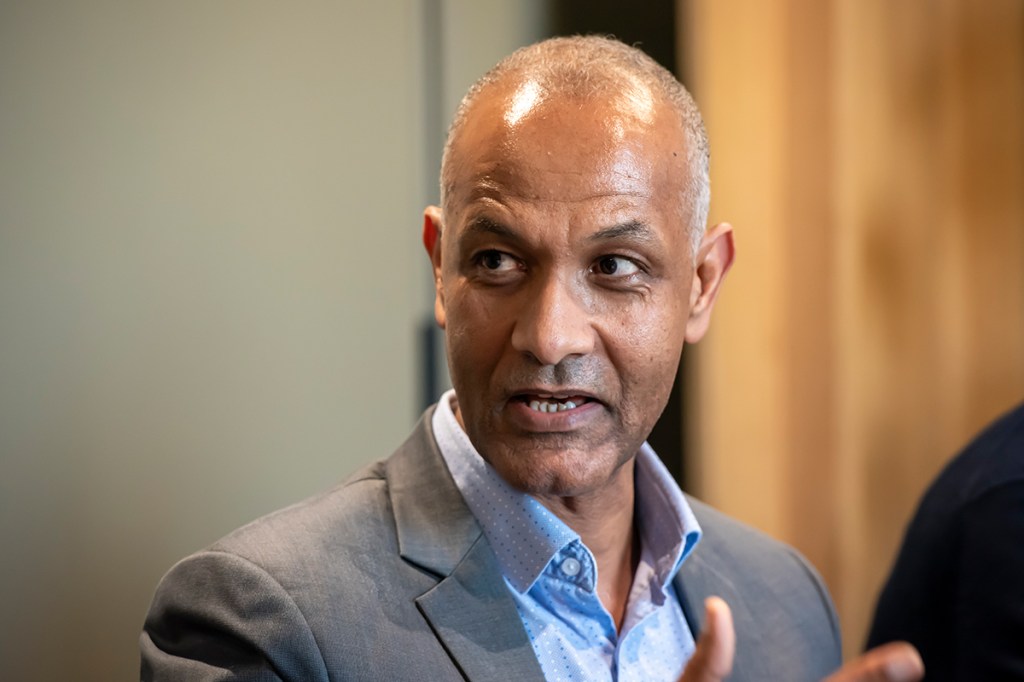

- Michael Fitsum, director, head of operations, M&G Real Estate

- Denz Ibrahim, head of futuring and place asset management, LGIM

- Allan Lockhart, chief executive, NewRiver

- Sabri Marsaoui, founder and director, Blackstar Real Estate

- Scott McKenzie, director of property management, Topland Group

- Natasha Patel, head of market intelligence, Avison Young

- Jack Sibley, head of proptech and innovation, Related Argent

- Hannah Smith, principal consultant, CACI

- Peter Stals, chief financial officer, VIA Outlets

- Simon Creasey, head of content, BE News (chair)

After years of being talked down, affected by the rise of online shopping and a myriad of closures, with the likes of Arcadia and JJB Sports going to the wall, physical retail seems to be getting back on track.

Deals and funds raised over the past few months show there is still an appetite for bricks and mortar. These include British Land’s circa £700m retail park shopping spree, Frasers Group’s acquisition of more than 1m sq ft of retail space to add to its growing portfolio of stores and NewRiver’s £50m-plus fundraised to support its possible takeover of Capital & Regional.

The question now is: could the rise of tech and data help level up the retail sector’s revival? And how can technology help sustain revenue generation and improve growth?

Retail investors, landlords and asset managers are currently using technology to address longstanding sales and pay points. But technology and data can also be harnessed to create a competitive edge, with advancements such as AI hailed as revolutionary by NewRiver’s Allan Lockhart – improving operations and decision-making.

“Technology has significantly disrupted the retail real estate sector over the last 10 to 15 years, and we’re now sitting on another revolution in terms of technology and AI,” said Lockhart.

Looking back to 15 years ago, he admitted that, in hindsight, he would have invested more in research and data “because when you’re buying real estate today, it’s very expensive – your upfront costs can equate to about 7%”.

Lockhart added: “With duration you’re vulnerable to risk and changes, as happened in the past. For us as a business, we’re thinking a lot more around what’s going to happen in the future, and we’re investing more in our data and in our systems.”

Tech Adoption

“Compared with those in other sectors, landlords and tenants in the retail sector are guilty of not being quick to adopt technology,” said Yardi’s Mike Cook. “Technology within the retail sector is nowhere near as well used as in the residential and coworking sectors, which have been more rapid in their adoption of tech,” he commented.

But according to Cook, there is now a realisation in the retail sector that data is needed and that, where possible, data should come from a single point of entry. “It needs to in order to run retail, where there’s more of a partnership with your brands or tenants,” he explained.

Peter Stals of VIA Outlets provided a European angle on collecting data from the 1,150 brands housed in the company’s 11 outlets on the continent. “We’re operationally intensive and collect a lot of data to manage our business, so in that sense, we’re data rich. And 20% to 25% of our GRI is based on variable rent, and that then drives the minimum base rent into the following years.”

Stals said VIA was “heavily dependent” on brand sales performance, adding: “While we are looking at this from a tenant covenant perspective, as opposed to more traditional real estate management models, our focus here is on optimising that brand sales performance to directly drive our own top line.”

“We’re operationally intensive and collect a lot of data to manage our business”

Peter Stals

VIA’s in-house retail teams use daily sales data, sales densities, capture and conversion rates and other metrics and performance data to see what’s performing well and what isn’t. That data then helps the company work with brands on a partnership basis to address issues and mutually optimise performance. It also enables it to make leasing decisions.

“Our lease structures have landlord flexibility to move brands in and out and around the centres,” said Stals. “These decisions are enabled on a day-to-day basis through the performance data we capture. Room to optimise that, automate it and analyse it further is always there.”

He added: “There is movement in the wider industry towards the niche [retail] sector in terms of lease structure and the partnership model.”

How brands are actually using the data they capture was a topic raised by Related Argent’s Jack Sibley. “When we look at our portfolio, the proportion of the smaller independents are using platforms like Shopify,” he said.

“Compared with five years ago, we’ve got more of that centralised data capture and automated analytics – that’s empowering them to use data to run their business and make business decisions.”

There was scepticism around the table, however, about the overuse and overreliance on data. On this point, Blackstar Real Estate’s Sabri Marsaoui said: “I’m not convinced data in isolation is the golden bullet to solving this retail crisis. Nowadays, as landlords, we have access to so many different types of data, and within itself, this can create issues – in trying to wade through the reams of available data points in the hope of finding the pertinent information to help us make decisions.”

Data Paralysis

Marsaoui said that while he understood the importance of understanding retailers’ transactional sales figures and density metrics, “sometimes in having too many different data points, it can lead to becoming paralysed by indecisiveness – as all too often you can always find different sources of data to substantiate conflicting conclusions”.

He added: “At Blackstar, we utilise relevant data to help us make informed decisions based on what we feel is right at that moment in time. We don’t get hung up on ‘what does the data say in isolation?’”

“That is why a distinction needs to be made between data and information,” said Michael Fitsum of M&G Real Estate. “The technology we’re referring to here is an enabler to manage the data and convert it into information,” he explained. “We can utilise the data in an efficient and effective manner and assist the decision-making process.”

“I’m not convinced data in isolation is the golden bullet to solving this retail crisis”

Sabri Marsaoui

According to Fitsum, if technology is being defined simply as data storage or a data gatherer, “then it is not delivering what it should”. He added: “We need to differentiate, and hopefully, we will see more advancement in that process where we have platforms that collect the right level of data and convert that into information to make efficient decision-making.”

The panel then turned to the issue of the financial side of installing and using the technology, and who should pay: the operator or the landlord. Marsaoui, whose firm, Blackstar, deals with the asset and property management of community shopping centres, which tend to have high numbers of smaller, independent occupiers, said: “The challenge we have is convincing these types of occupiers to invest in and adopt technology because of the high costs associated with doing so.”

He added that his viewpoint was skewed, because he had spent his entire career working in the secondary and tertiary community end of shopping centres, not the premium end. “As landlords at this end of the market, we don’t have endless pots of gold to invest,” he said. “We must be careful where we deploy our cash. From my many years of experience, occupiers prefer for us to invest our capex into improving the public realm and facilities

to make the centre more appealing.”

Topland’s Scott McKenzie agreed, saying that with any small, independent family business, technology becomes a cost. “They’re looking at it and saying: ‘Well, if you’re investing in it as landlord, then happy days. Thank you very much – I’ll have some of that. But if you’re asking me to pay for it and it’s straight off my bottom line, then I don’t need that. It’s something I can do without.’”

LGIM’s position as a long-term investor, owner and developer allows it to invest in assets that have the potential to have a multifaceted impact – reaching investors as well as society, according to LGIM’s Denz Ibrahim. “With our patient capital, we can take a much longer-term view when curating future-ready environments,” he explained.

By investing in and partnering with independents, such as those in its build to rent neighbourhoods, its street markets and the Kingland Cresent scheme in Poole, “we [LGIM] deliver curated, relevant places, supporting occupiers through flexible leasing packages and ready-to-move-in spaces”, said Ibrahim, adding: “Not only this, but we also supply key technology, which allows us to learn and adapt, together with the occupiers.”

Agile Environments

He added that strategically incorporating technology had enabled LGIM to better understand customers and occupiers and measure the intrinsic value for the wider asset, whether it is spend, dwell, engagement, journeys or foot-flow, “so we deliver environments that are responsive and agile”.

There was consensus around the table that regardless of who pays, getting tenants to use the tech can be a struggle. “For us as a business, the biggest problem is the buy-in to use the data or to use technology,” said McKenzie. Topland started using Yardi’s technology in 2022, and McKenzie said operators still do not use the system as well as they should. “It doesn’t matter what you’ve got – if you haven’t got people that are going to use it, it means nothing,” he added.

Discussion then moved on to the current wonderkid of the technology world: AI. “[AI] has changed the world,” said Lockhart. “The reality is that we don’t yet know to what extent. We’ll be able to ask questions around every subject matter. It’s going to be really fascinating as to how that is going to change the world we’re in. But it’s all based on data.”

“We can accurately tell a location how influential a store is in triggering online spend”

Hannah Smith

‘Making Lives Easier’

Hannah Smith said CACI was working on numerous things with AI “that will really help with our world and make our lives easier”. Part of CACI’s work is an Online Halo analysis that demonstrates how investment in physical stores encourages more people to come in and engage. She added that while

the customers might not make that purchase in the shop at the time, they may do so later when they are online at home.

According to Smith, there was previously no way of capturing that data, but CACI’s AI Online Halo analysis uses actual in-store versus physical spend at a brand level across catchment. “So we can accurately tell a location how influential a store is in triggering online spend – then we can start to make more intelligent decisions in terms of leases: how much rent and how fair those negotiations are,” she said.

Avison Young’s Natasha Patel said everyone needed to be wary the problems we are actually solving by using AI.

“Significant money can be invested in AI – particularly given the hype surrounding it – to solve something which is minor, but there needs to be more thought around what the significant problems that need to be solved are, and whether AI can help,” she explained.

Patel also said the industry should look at the bias in some of AI’s large language models: “There’s been enough thought process around it, but how do we solve bias in these models? We’re talking about the decision-making process and predictive analytics, which is fantastic, but we must think carefully about the data that’s powering these tools, so we don’t get a level of bias when we’re just using these ChatGPT-type tools to ask questions and get the results.”

Clear Definition Needed

“AI technology and different forms of data are one part of the equation alongside gut feel”

Natasha Patel

Cook said he totally agreed with the concerns about AI and identifying the problems it is solving. “There is so much noise around AI that it can become confusing for the end users,” he stated, adding “that there needs to be clear definition on what AI is solving and its relevance and benefit to the end user – otherwise it may not be utilised and become redundant very quickly”.

According to Patel, it is important that data, technology and AI are not seen as a magic solution to all problems. “They’re not. AI technology and different forms of data are one part of the equation, alongside gut feel and going off and seeing an asset or speaking to the occupiers,” she said.

For Lockhart, getting the right dataset and systems, which can be processed quickly, with the right sort of analysis that enables and empowers teams to make better decisions, “will lead to better capital allocations, which is an important driver of the success of a company”.

Ultimately, said Marsaoui, technology and data “are obviously going to continue to be a key element in the revival and repositioning of our failing retail spaces”. He added: “However, I absolutely believe the data must be used alongside an entrepreneurial mindset and gut feeling. I don’t want us to

lose sight of how important and critical that is to the future success of our retail centres.”

First published on BE News | PDF Version