Debt is a strategic tool for real estate professionals aiming to expand or diversify their portfolios without overburdening capital reserves. Managing CRE debt comes with various challenges and obligations, such as meeting lender covenants, adhering to critical deadlines, and tracking loan amortisation schedules.

Consistently staying on top of these requirements is essential for minimising debt risk and maintaining financial stability throughout the loan duration.

Efficiently Navigating CRE Debt Risks with a Loan Management Platform

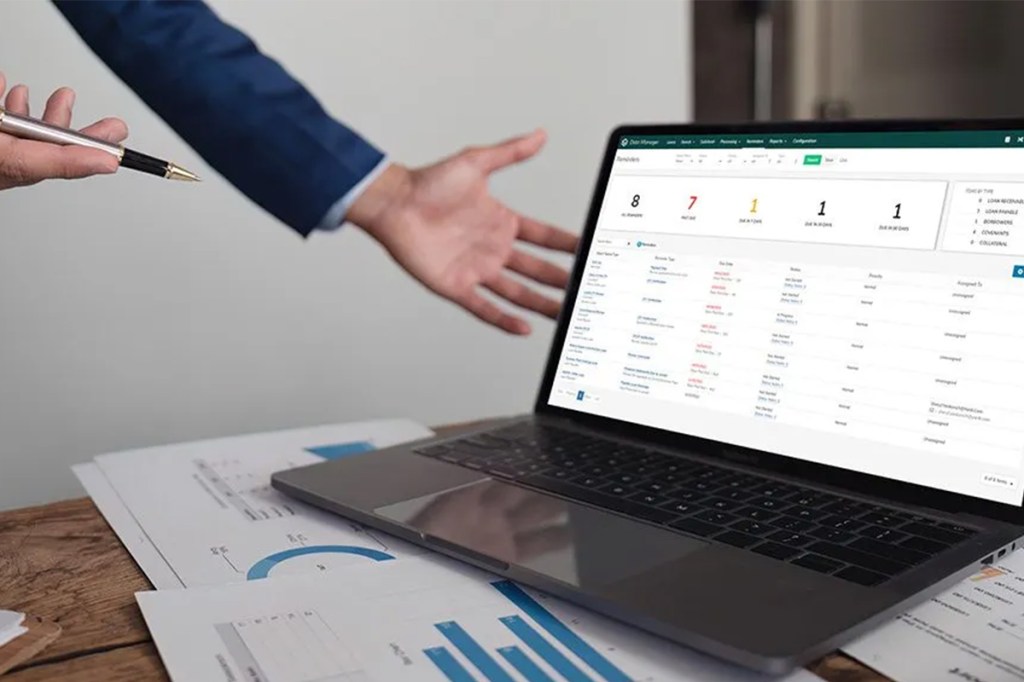

Leveraging a CRE debt management system allows borrowers to tackle debt challenges and risks seamlessly. Debt management platforms, such as Yardi’s, are designed specifically for CRE and serve as a centralised hub for all loan data, simplifying every aspect of debt management. These platforms automate complex loan term calculations, eliminating spreadsheets and the risks associated with disparate data.

Monitoring Loan Covenants

Effective CRE debt management requires close monitoring of loan covenants. This includes maintaining critical terms like the debt service coverage ratio (DSCR), loan-to-value (LTV) ratio and net operating income (NOI) within limits defined by the lender. Debt management platforms provide continuous visibility into key covenants, with real-time alerts when specific terms reach thresholds that need attention. This proactive approach helps borrowers ensure compliance and minimise the risk of default due to missed obligations.

Centralising Loan Data

Consolidating all loan-related information in a single platform mitigates the risks of managing data across multiple disconnected systems. Debt management platforms act as a centralised hub, enabling borrowers to easily store and access loan data while providing visibility into the debt portfolio for all key stakeholders. By replacing error-prone spreadsheets and manual data entry with an integrated debt management platform that syncs with your property management system, you can significantly enhance data accuracy and operational efficiency.

Tracking Loan Collateral and Critical Dates

Debt management platforms help borrowers efficiently track important lender requirements. This includes critical loan dates such as maturity, renewal deadlines and interest rate adjustments. These platforms enable users to set recurring reminders with notifications and track collateral changes through a comprehensive change history. In addition, they help borrowers maintain compliance and minimise risk exposure by ensuring these milestones are met on time.

Automating Payments

Borrowers’ primary obligation to lenders is to ensure timely and accurate loan repayments. Debt management platforms automate payments to lenders, helping borrowers stay on top of their payment schedules. These platforms also provide complete visibility into payment history with an audit trail, ensuring transparency and accountability.

Insights into Amortisation Schedules

Debt management platforms can manage loans of any type or complexity, with the ability to automatically calculate and adjust loan terms. These platforms track loan term changes over time, providing detailed insights into how these adjustments affect the amortisation schedule and long-term repayment obligations. This helps borrowers identify potential risks early and make informed decisions.

Real-time Loan Metrics

Access to accurate and up-to-date debt portfolio metrics is essential for maintaining an organisation’s financial stability. These platforms have comprehensive dashboards that allow borrowers to gain in-depth insights into key loan metrics, such as outstanding balances, interest rates and payment statuses. This information helps streamline financial consolidations, simplify reporting and support informed decision-making.

Activity Tracking

Debt Management platforms also help to facilitate collaboration through a shared activity feed, ensuring that loan-related actions are completed on time. Borrowers can assign tasks within their organisation, receive real-time status updates and maintain a comprehensive record of all interactions. This feature reduces the risk of miscommunication and missed deadlines, providing a transparent and accountable framework for managing CRE debt effectively.

Dedicated debt management solutions, such as Yardi Debt Manager, are invaluable tools for developing successful and practical debt strategies.