The building of the future has the potential to mix asset classes in a much more beneficial way for tenants — if only developers and landlords know how to deliver it.

That’s the message from Yardi’s Regional Director, International Solution Consulting Fay Chester. If technology is used to its full potential, real estate developers and landlords will be able to better understand the best way to increase revenue while providing exactly what people need today.

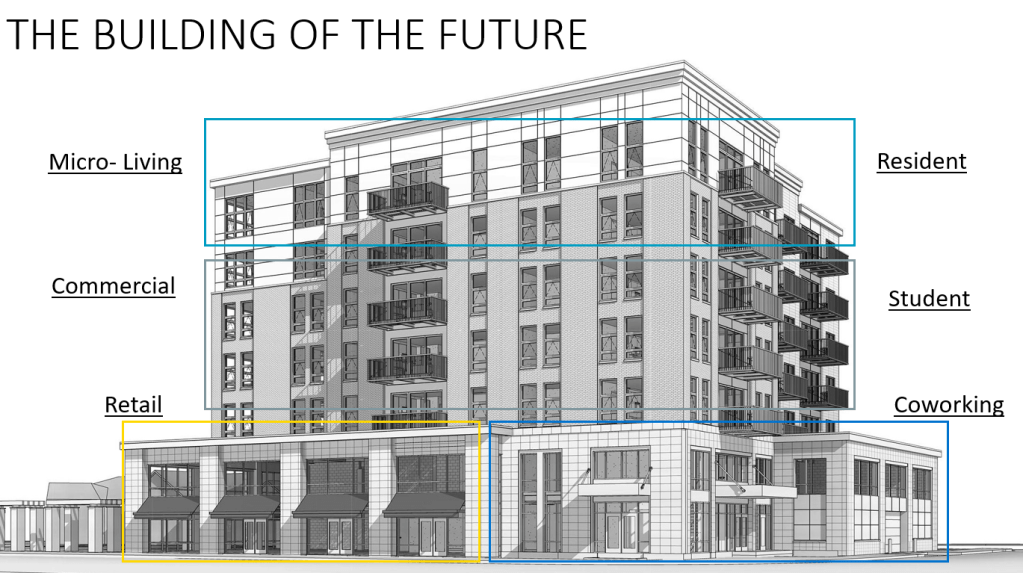

“Real estate has traditionally been driven by asset class,” Chester said. “The industry has built its business model around the different streams such as residential, or offices, or retail. But now, it’s not that simple. Now we can look at a building and see what the best option is, which is far more likely to be a combination.”

The need to include multiple assets in a building has been driven by the pandemic, Chester said. The lines between work life and home life have blurred, and hybrid working means that people want to access not only workspaces but retail and leisure in different ways.

“The concept of mixed-use isn’t new, but the building of the future will be an extension of that,” she said. “It could be a combination of asset classes that were previously separate, for example, residential offering long- or short-term leases, above an office, which is above the retail that services that office and those residents.”

Combining assets in a building more fluidly is a way to attract tenants, Chester said. However, not all developers and landlords are ready yet to deliver multiple asset classes. Once they have ascertained which blend of uses might be the best option for a building, they could face a steep learning curve. For example, they might not be aware of the apps that today’s office tenants expect to have access to.

“Owners and investors need to embrace technology to support them,” she said. “They might not have used certain technologies before because they weren’t relevant — a residential operator had no need for an app to manage a flexible workspace. But they will have to use the tools available if they are to deliver and create the service that people expect today.”

The technology is there to create buildings that meet people’s needs, but many developers and landlords are yet to adopt it, Chester said. For many, technology is not yet a high enough priority.

Yardi recently carried out a survey with the European Public Real Estate Association to ascertain the uptake of proptech tools across Europe. Nearly 50% of respondents claim that proptech solutions are a lower priority than other business initiatives, while 33% are hesitant to invest in further solutions due to low technological maturity.

However, the survey results suggest that the real estate sector believes that using technology should form at least part of a business strategy. Nearly 70% of respondents strongly classified technology as a business topic rather than an IT topic. Future investment would be aimed at making more informed investment decisions, according to 68.2% of respondents.

“The industry understands the need for technology, but adoption is lagging,” Chester said. “A lot is being considered but is not yet seen as a priority. But people know change is coming. Investor needs and client needs will push them in the end, as this is where income comes from.”

One way that technology’s adoption can be increased across the real estate sector is to educate people about the tools on offer, Chester said. Those who have worked across the industry for some years won’t be familiar with all the technology available.

“All career paths are taught in a certain way to become a surveyor, an architect or a property manager,” Chester said. “We need to reassess how things are taught in the real estate industry. Courses must adapt so people have the skills to know how to create the buildings of the future. After all, it’s the individuals in these organisations who will evolve our cities.”

This article was first published on Bisnow.